Personal Tax ID Number & Local Tax Office

TU Dortmund University is obliged to ask scholarship holders for their personal tax identification number ("Steuer-IdNr") and the local tax office responsible for them and report information on scholarships paid to the recipient's tax office.

What Is a Tax ID Number?

The Federal Central Tax Office (BZSt) automatically generates a personal tax identification number for every person registered in Germany.

This tax ID number must be quoted when submitting applications, declarations or notifications to the tax authorities.

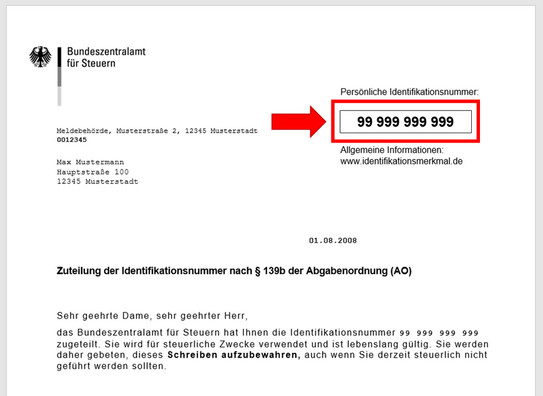

The tax ID number is an eleven-digit number and does not contain any encrypted information about the person concerned. The tax ID number is valid for life and never changes.

Where to Find Your Tax ID Number

You can find your personal tax ID number on a letter you received from the Federal Central Tax Office. If you were born in Germany, ask your parents for this letter if necessary. If you have only recently registered in Germany, your tax identification number will have been sent to you by mail.

If You Cannot Find Your Tax ID Number

If you do not have the letter informing you of your personal tax ID number, you can also find it on your income tax assessment notice or on your wage tax statement.

If you do not have these documents either, you can request your tax ID number from the Federal Central Tax Office.

How to Find the Tax Office Responsible for You

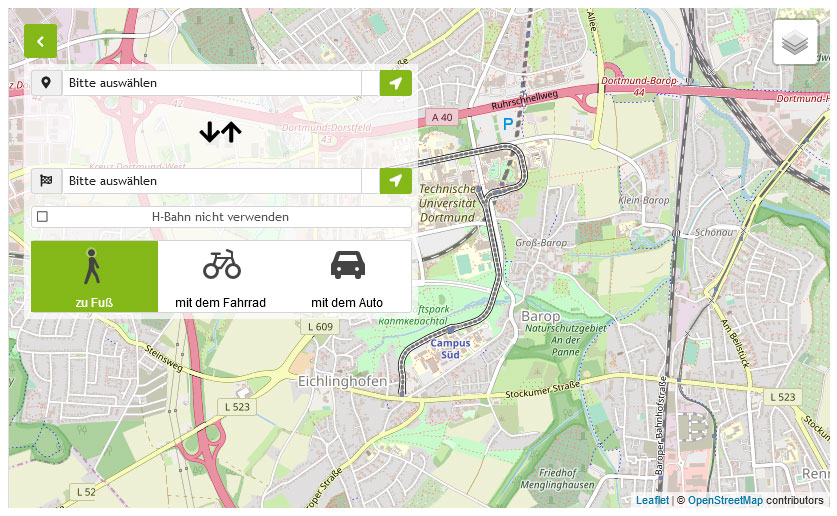

You can find out which local tax office is responsible for you on the website of the North Rhine-Westphalia tax authorities.

The jurisdiction depends on your registration address in Germany.

Contact for Questions

The staff member of the International Office who is responsible for your scholarship program at TU Dortmund University can help you. This is the person with whom you are already in contact.